Looking for an answer to the question: Are 1099s reported to the irs? On this page, we have gathered for you the most accurate and comprehensive information that will fully answer the question: Are 1099s reported to the irs?

1099 Rules indicate that corporations are exempt from receiving 1099 statements, EXCEPT for certain items which you must report on a 1099. Medical or Health care payments are reportable, but non-employee compensation (contractor payments) are not reported. A non-profit is considered to be engaged in a business or trade.

Substitute Form 1099 S – Generally, the issuer/payor of this business income type is needed to issue 1099 Forms to each person or unincorporated entity who has obtained any quantity or payment of income or rental on behalf of the company.

A 1099 is required for payments of $600 or more made to any contract employees, attorneys or accountants; for any payments larger than $10 for royalties, tax exempt interest or substitute dividends; for rent payments higher than $600, unless paid to a real estate agent; for any prize payments over $600; and for payments to members of fishing boat …

Are 1099s submitted to IRS?

You must send Copies A of all paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the IRS with Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Will the IRS know if I don’t file a 1099 R?

When you file your income tax return, the information is checked against the numbers the IRS has on file. If you fail to report a 1099-R, the IRS will know since it already has its own copy. If you file a tax return without a 1099-R you received, your information will not match the records the IRS has.

What happens if I don’t file my 1099?

In short, if you don’t file a 1099, you’re almost guaranteed to get a tax or an IRS audit notice. … It is your responsibility to pay for the taxes you owe even if you don’t receive a 1099 form from your employer or payer (the deadline for them to mail out 1099s to contractors is January 31st).

How much can you make on a 1099 before you have to claim it?

If you earn $600 or more as a self-employed or independent subcontractor for a business from any one source, the payer of that income must issue you a Form 1099-MISC detailing exactly what you were paid.

How do you report a 1099-s on your tax return?

Personal Use. If you’re reporting Form 1099-S because you sold your primary residence, then you’ll report the sale of the home on Form 8949 and Schedule D. If you’re reporting Form 1099-S because you sold a timeshare or vacation home, then you’ll also report the sale on Form 8949 and Schedule D.

Who is exempt from receiving a 1099 form?

Business structures besides corporations — general partnerships, limited partnerships, limited liability companies and sole proprietorships — require Form 1099 issuance and reporting but only for amounts exceeding $600; anyone else is 1099 exempt.

What do I do with a 1099s?

If you do receive Form 1099-S, you must report the sale of your home on your tax return, even if you do not have to pay tax on any gain. You must meet all of these qualifications to exclude the gain from the sale of your home from income: You must own the property for at least two of the previous five years.

How can I avoid paying taxes on a 1099?

Legal methods you can use to avoid paying taxes include things such as tax-advantaged accounts (401(k)s and IRAs), as well as claiming 1099 deductions and tax credits. Being a freelancer or an independent contractor comes with various 1099 benefits, such as the freedom to set your own hours and be your own boss.

Will I get audited if I forgot a 1099?

Each Form 1099 is matched to your Social Security number, so the IRS can easily spew out a tax bill if you fail to report one. In fact, you’re almost guaranteed an audit or at least a tax notice if you fail to report a Form 1099. … Like Forms W-2, Forms 1099 are supposed to be mailed out by January 31st.

Does the IRS catch unreported 1099?

There’s a good chance they’ll catch it. It’s best to set aside money for your 1099 taxes, and report your freelance income based on your records if you haven’t received a 1099-MISC. If necessary, file an amendment for your tax return if any 1099’s received are different than reported.

How does the IRS find out about unreported income?

Unreported income: If you fail to report income the IRS will catch this through their matching process. … If the IRS notices that a third party reported that they paid you income but you don’t have that income reported on your return this immediately lifts a red flag.

Do all 1099 have to be reported?

Since the IRS considers any 1099 payment as taxable income, you are required to report your 1099 payment on your tax return.

What happens if I dont report 1099 income?

In short, if you don’t file a 1099, you’re almost guaranteed to get a tax or an IRS audit notice. … It is your responsibility to pay for the taxes you owe even if you don’t receive a 1099 form from your employer or payer (the deadline for them to mail out 1099s to contractors is January 31st).

Do I have to report all 1099 income?

Sometimes, 1099s are issued and the IRS receives them but the taxpayer doesn’t and the income did not get reported on their tax returns. … It is important to include all of your income on your tax returns regardless of whether or not you receive a 1099 form.

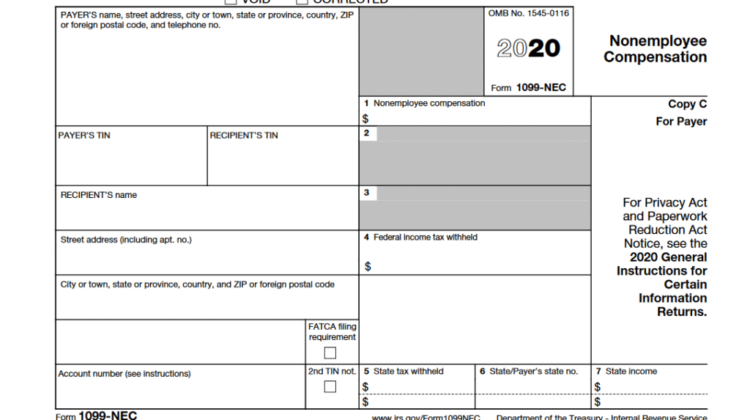

How much can you make 1099 without paying taxes?

In most circumstances, your clients are required to issue Form 1099-NEC when they pay you $600 or more in any year. As a self-employed person, you’re required to report your self-employment income if the amount you receive from all sources totals $400 or more.

How do I report a 1099-s on my tax return?

If the 1099-S was for the sale of business or rental property, then this is reportable on IRS Form 4797 and Schedule D: From within your TaxAct return (Online or Desktop) click on the Federal tab. On smaller devices, click in the upper left-hand corner, then select Federal.

Who is responsible for filing 1099s?

If you close the transaction yourself, you will be responsible for filing a Form 1099-S to report it. Most real estate purchase agreements also contain a clause stipulating that the seller is responsible for reporting the proceeds of the sale to tax authorities.

Do you have to send a 1099 if under $600?

This is the amount the payer (employer, organization, etc.) is required to report on a 1099 in order to issue it to you. … For example, if you earned less than $600 as an independent contractor, the payer does not have to send you a 1099-MISC or 1099-NEC, but you still have to report the amount as self-employment income.

Who is exempt from 1099s?

Business structures besides corporations — general partnerships, limited partnerships, limited liability companies and sole proprietorships — require Form 1099 issuance and reporting but only for amounts exceeding $600; anyone else is 1099 exempt.

Who is exempt from 1099s reporting?

The IRS provides an exemption from the Form 1099-S reporting requirement for the sale of your principal residence if you are married and your gain from the sale is $500,000 or less. If you are unmarried, gains of $250,000 or less are exempt.