Looking for an answer to the question: Are 1035 exchanges taxable? On this page, we have gathered for you the most accurate and comprehensive information that will fully answer the question: Are 1035 exchanges taxable?

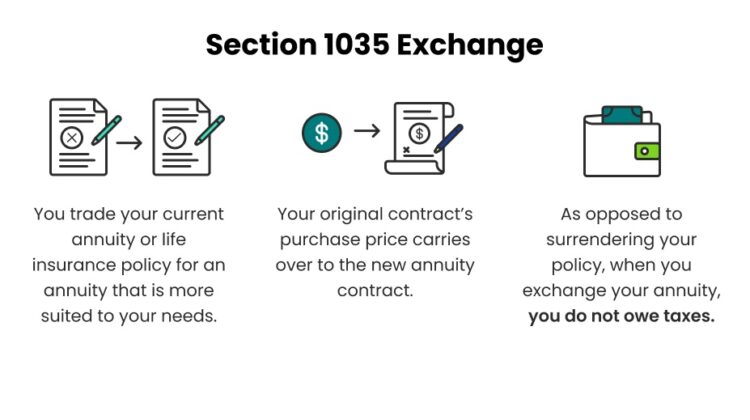

What is ‘Section 1035 Exchange‘. A 1035 exchange is a requirement in the IRS tax code allowing a tax-free transfer of an existing annuity contract, life insurance policy, long-term care product, or endowment for another one of like kind.

The 1035 exchange is a tax code provision that makes it possible to transfer certain assets without requiring you to pay taxes on that money. The 1035 exchange works with annuities, endowment policies, and life insurance policies.

A 1035 exchange is a provision to the tax code that allows you to transfer funds from a life insurance policy or variable annuity to another policy or annuity. All of this is can be done without creating an event in which you are taxed additional money.

Why would a client want to comply with section 1035 in a transaction to replace a whole life policy?

A 1035 Exchange allows the contract owner to exchange outdated contracts for more current and efficient contracts, while preserving the original policy’s tax basis and deferring recognition of gain for federal income tax purposes.

What is the capital gain tax for 2020?

Long-term capital gains tax is a tax applied to assets held for more than a year. The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income. These rates are typically much lower than the ordinary income tax rate.

Is a 1035 exchange qualified?

In most cases, the IRS allows what is known as a 1035 exchange of non-qualified annuity contracts between insurance companies. A 1035 exchange lets you switch companies while continuing to defer taxes, ensuring that your annuity stays up-to-date with the latest advantages and benefits available to you.

Do I have to report a 1035 exchange on my tax return?

Will I receive a tax form for a 1035 exchange? You will receive a 1099-R to report a 1035 exchange to another insurance company. However, a 1035 exchange is not a taxable event. All 1035 exchanges are reportable and the distribution code of ‘6’ on the tax form indicates to the IRS it was a tax-free 1035 exchange.

What is the capital gains exemption for 2021?

For single taxpayers, you may exclude up to $250,000 of the capital gains, and for married taxpayers filing jointly, you may exclude up to $500,000 of the capital gains (certain restrictions apply).1.

How do I report a 1035 exchange?

You may have to report exchanges of insurance contracts, including an exchange under section 1035, under which any designated distribution may be made. For a section 1035 exchange that is in part taxable, file a separate Form 1099-R to report the taxable amount.

At what age are you exempt from capital gains tax?

55 The over-55 home sale exemption was a tax law that provided homeowners over the age of 55 with a one-time capital gains exclusion. Individuals who met the requirements could exclude up to $125,000 of capital gains on the sale of their personal residences.

At what income level do you not pay capital gains tax?

For example, in 2021, individual filers won’t pay any capital gains tax if their total taxable income is $40,400 or below. However, they’ll pay 15 percent on capital gains if their income is $40,401 to $445,850. Above that income level, the rate jumps to 20 percent.

What will capital gains tax be in 2021?

Capital Gains Tax Overview Based on filing status and taxable income, long-term capital gains for tax year 2021 will be taxed at 0%, 15% and 20%. Short-term gains are taxed as ordinary income. After federal capital gains taxes are reported through IRS Form 1040, state taxes may also be applicable.

Is there a fee for a 1035 exchange?

There are no specific fees for a 1035 exchange. But there may be fees for getting out of of your existing annuity in the form of surrender fees are typically not waived for 1035 exchanges. However, if exchanged from one product to another within the same company, it’s possible that your fees would be waived.

What states have no capital gains tax?

The states with no additional state tax on capital gains are:Alaska.Florida.New Hampshire.Nevada.South Dakota.Tennessee.Texas.Washington.

Is a 1035 exchange taxable in PA?

Exchange of Insurance Contracts Under IRC Section 1035 31, 2004, Act 40 of July 7, 2005 provides that exchanges of insurance contracts under IRC Section 1035 that are tax exempt for federal income tax purposes are also tax exempt for Pennsylvania personal income tax purposes.

When can you do a 1035 exchange?

Generally, the Section 1035 exchange rules allow the owner of a financial product, such as a life insurance or annuity contract, to exchange one product for another without treating the transaction as a sale—no gain is recognized when the first contract is disposed of, and there is no intervening tax liability.

How do I avoid capital gains tax?

If you hold an investment for more than a year before selling, your profit is typically considered a long-term gain and is taxed at a lower rate. You can minimize or avoid capital gains taxes by investing for the long term, using tax-advantaged retirement plans, and offsetting capital gains with capital losses.

What is the difference between a 1035 exchange and a rollover?

An indirect rollover is not taxable unless it’s a Roth conversion. Exchange, 1035 Exchange — similar to a direct rollover or direct transfer, but with nonqualified accounts. It allows life insurance, long-term care insurance or other annuities to be exchanged for an annuity.

How do 1035 exchanges work?

A 1035 exchange is a legal way to exchange one insurance policy, annuity, endowment or long-term care product of like kind without triggering tax on any investment gains associated with the original contract. … If annuity payments are taxable, then the tax is simply deferred until you begin receiving payments from it.

What is not allowable in 1035 exchange?

So what is not allowable in a 1035 exchange? Single Premium Immediate Annuities (SPIAs), Deferred Income Annuities (DIAs), and Qualified Longevity Annuity Contracts (QLACs) are not allowed because these are irrevocable income contracts.

Is a 1035 exchange a good idea?

But FINRA warns that 1035 exchanges may not be a good idea for you. Often, bonuses or premiums can be offset by other charges added to the contract. … The new contract may also come with higher annual fees, and you might not need the extra features of the new contract, which can be expensive.

How much is capital gains on $100000?

But had you held the stock for less than one year (and hence incurred a short-term capital gain), your profit would have been taxed at your ordinary income tax rate. For our $100,000-a-year couple, that would trigger a tax rate of 22%, the applicable rate for income over $81,051 in 2021.

Do you pay capital gains tax at closing?

Because capital gains can only be assessed when an investment is sold, you pay this tax when selling property to another party. … And even though it’s applicable when selling a home, you don’t pay this tax as part of your closing costs.