Looking for an answer to the question: Are 1098 forms sent to the irs? On this page, we have gathered for you the most accurate and comprehensive information that will fully answer the question: Are 1098 forms sent to the irs?

Key Takeaways: Form 1098 is used to report mortgage interest paid for the year. Lenders are required to issue Form 1098 when a homeowner has paid $600 or more in mortgage interest during the tax year. To deduct mortgage interest, you must be the primary borrower on the loan, and be actively making payments. More items…

The lender is required to furnish Form 1098 to the borrower and to the IRS. The 1098 form provides information related to the points and interest to the borrower and the IRS. A borrower, who receives Form 1098 indicating the amount of mortgage interest and points paid, can deduct this amount from the income.

Form 1098 is a form filed with the Internal Revenue Service (IRS) that details the amount of interest and mortgage-related expenses paid on a mortgage during the tax year. These expenses can be used as deductions on a U.S. income tax form, Schedule A, which reduces taxable income and the overall amount owed to the IRS.

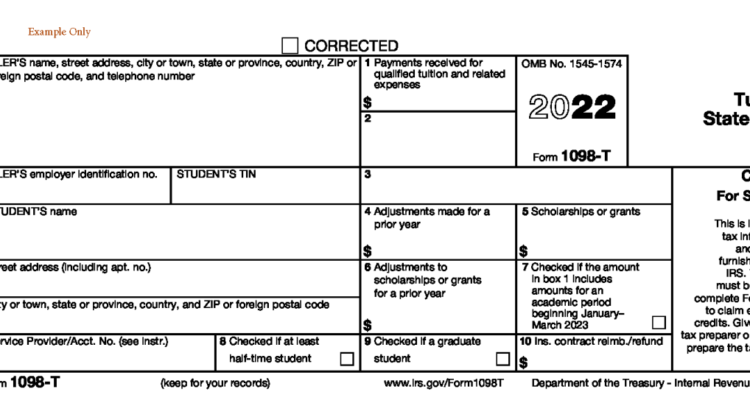

Eligible colleges or other post-secondary institutions must send Form 1098-T to any student who paid “qualified educational expenses” in the preceding tax year. Qualified expenses include tuition, any fees that are required for enrollment, and course materials required for a student to be enrolled at or attend an eligible educational institution.

How much was the second stimulus 2021?

Second round of direct payments: December 2020-January 2021 It provided a one-off check of up to $600, but this time, households were also able to claim an additional $600 for child dependents aged 16 or under.

Does a 1098-T increase refund?

Your 1098-T may qualify you for education-related tax benefits like the American Opportunity Credit, Lifetime Learning Credit, or the Tuition and Fees Deduction. … If the credit amount exceeds the amount of tax you owe, you can receive up to $1,000 of the credit as a refund.

How much does a 1098 help with taxes?

A form 1098-T, Tuition Statement, is used to help figure education credits (and potentially, the tuition and fees deduction) for qualified tuition and related expenses paid during the tax year. The Lifetime Learning Credit offers up to $2,000 for qualified education expenses paid for all eligible students per return.

Do Schools report 1098-T to IRS?

Your 1098-T form, sometimes dubbed as the “college tax form” will show you the amount you paid for qualified education expenses (in Box 1). The amount is reported by the school to you and the IRS.

Does 1098-T give you money back?

Your 1098-T may qualify you for education-related tax benefits like the American Opportunity Credit, Lifetime Learning Credit, or the Tuition and Fees Deduction. … If the credit amount exceeds the amount of tax you owe, you can receive up to $1,000 of the credit as a refund.

What happens if my school doesn’t give me a 1098-T form?

You can still claim an education credit if your school that closed did not provide you a Form 1098-T if: The student and/or the person able to claim the student as a dependent meets all other eligibility requirements to claim the credit. The student can show he or she was enrolled at an eligible educational institution.

Will we get a third stimulus check?

The $1.9 trillion coronavirus relief plan includes a third round of $1,400 stimulus payments, topping off the $600 checks that were already approved by Congress in December 2020, and adding up to $2,000.

Do all students receive a 1098-T?

Not all students are eligible to receive a 1098-T. Forms will not be issued under the following circumstances: The amount paid for qualified tuition and related expenses* in the calendar year is less than or equal to the total scholarships disbursed that year.

What happens if I don’t include 1098-T?

If you did not receive your IRS Form 1098-T from your school, you can still claim education credits and expenses, as long as you have records that prove you’re qualified to claim them.

How does Form 1098 affect my taxes?

A form 1098-T, Tuition Statement, is used to help figure education credits (and potentially, the tuition and fees deduction) for qualified tuition and related expenses paid during the tax year. … The tuition and fees deduction can reduce the amount of your income subject to tax by up to $4,000.

Does a 1098 increase refund?

Your 1098-T may qualify you for education-related tax benefits like the American Opportunity Credit, Lifetime Learning Credit, or the Tuition and Fees Deduction. … If the credit amount exceeds the amount of tax you owe, you can receive up to $1,000 of the credit as a refund.

How much money can you get back from a 1098-T?

A form 1098-T, Tuition Statement, is used to help figure education credits (and potentially, the tuition and fees deduction) for qualified tuition and related expenses paid during the tax year. The Lifetime Learning Credit offers up to $2,000 for qualified education expenses paid for all eligible students per return.

When was second stimulus check sent out?

The IRS delivered virtually all of the second round of stimulus checks in less than a month, starting Dec. 29, 2020, two days after then-President Donald Trump signed the $900 billion bill into law.

Can you get in trouble for not filing 1098-T?

The penalties are: $30 per form if you correctly file within 30 days, maximum penalty $250,000 per year ($75,000 for small businesses). … $100 per form if you file after August 1 or do not file Form 1098-T, maximum penalty $1,500,000 per year ($500,000 for small businesses).

Why does my 1098-T lower my refund?

Two possibilities: Grants and /or scholarships are taxable income to the extent that they exceed qualified educational expenses to include tuition, fees, books, and course related materials. So, taxable income may reduce your refund.

Do I need to send a copy of my 1098?

No, a 1098-T is an informational document and need not be sent with your return. However, you should send any tax document that designates withholding such as a W-2 and 1099.

How much is the second stimulus check?

The second stimulus checks for the COVID-19 relief package are set to total $600 per person, with phase outs based on adjusted gross income limits that are similar to the first relief package. Families also get additional $600 payments for each qualifying dependent under age 17.

What do I do if I did not receive a 1098-T?

If you don’t receive a Form 1098-T by Jan 31st, you can still enter your school expenses without a Form 1098-T. The IRS does not explicitly require a Form 1098-T in order to claim any education-related credits. … To enter the expenses, simply proceed with the education section of TurboTax as normal.

What was the 3rd stimulus check amount?

$1,400 Most families will get $1,400 per person, including all dependents claimed on their tax return. Typically, this means a single person with no dependents will get $1,400, while married filers with two dependents will get $5,600.

How much is the first stimulus check?

The CARES Act was signed into law on March 27, 2020, and the first stimulus check, which maxed out at $1,200 per person (with an extra $500 per dependent), would have arrived as early as mid-April 2020, either as a paper check in your mailbox or via direct deposit into your bank account.