Looking for an answer to the question: Are 1099 r distributions taxable? On this page, we have gathered for you the most accurate and comprehensive information that will fully answer the question: Are 1099 r distributions taxable?

What is ‘Form 1099-R’. It is one of the forms in the 1099 series of forms that are known as “information returns.”. The 1099 forms are also used to report various types of income that a person may receive, other than salaries, such as independent contractor income, interest and dividends, government payment and many more.

Unfortunately the amount from a Form 1099–R is not considered “earned income” for purposes of the earned income credit. Earned income is wage income from a Form W-2 or self-employment income from a business.

The 1099-A form is one of the forms used to report income to the United States Internal Revenue Service ( IRS ). The 1099-A form is usually used to help taxpayers accurately report a home foreclosure on that year’s federal income tax return. This form is normally issued when a homeowner fails to make timely payments on…

Do you pay self employment tax on distributions?

S-Corp distributions You’ll still be liable for self-employment taxes on the salary portion of your income, but you’ll just pay ordinary income tax on the distribution portion. Depending on how you divide your income, you could save a substantial amount of self-employment taxes just by converting to an S-corporation.

What happens if I don’t file my 1099-R?

If you file a tax return without a 1099-R you received, your information will not match the records the IRS has. In the case of a form such as a W2 or a 1099-R, this will usually result in the IRS sending you a letter requesting the omitted form.

Does 1099R get reported to IRS?

A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts, many of which are retirement savings accounts. … The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they issue.

Do I have to pay taxes on a 1099-R?

You’ll most likely report amounts from Form 1099-R as ordinary income on line 4b and 5b of the Form 1040. The 1099-R form is an informational return, which means you’ll use it to report income on your federal tax return.

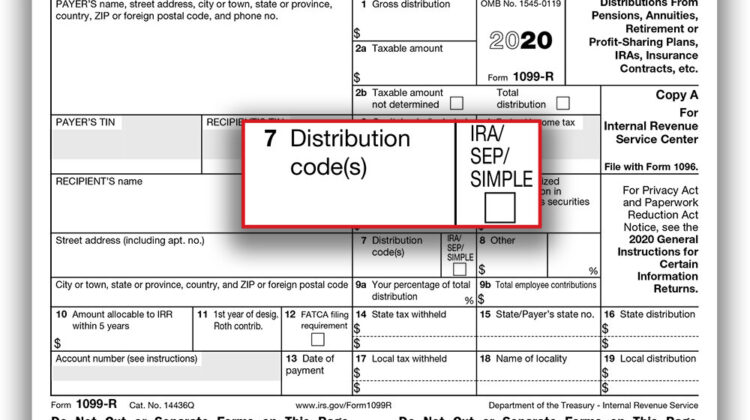

Is distribution code 7 taxable?

If Box 7 of your 1099-R shows a 7 in it, this distribution isn’t taxable if you met the plan requirements (the age and/or years of service required by the plan) for retirement, and you retired after meeting those requirements.

What is total distribution on a 1099-R?

Form 1099-R – Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., is a source document that is sent to each person that receives a distribution of $10 or more from any profit-sharing or retirement plans, any individual retirement arrangements (IRAs), annuities, …

Do distributions count as income?

If you’re 59½ or over and don’t meet the 5-year rule, distributions count as income, and you’ll pay taxes on them but not the 10% early withdrawal penalty. There are exceptions to the qualified distribution rule.

How do I determine the taxable amount of an IRA distribution?

Take the total amount of nondeductible contributions and divide by the current value of your traditional IRA account — this is the nondeductible (non-taxable) portion of your account. Next, subtract this amount from the number 1 to arrive at the taxable portion of your traditional IRA.

Are distributions income?

A distribution is a company’s payment of cash, stock, or physical product to its shareholders. Distributions are allocations of capital and income throughout the calendar year.

How much are distributions taxed?

What is the dividend tax rate? The tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status. The tax rate on nonqualified dividends is the same as your regular income tax bracket. In both cases, people in higher tax brackets pay a higher dividend tax rate.

Are distributions considered taxable income?

Money that you take out of the account is called a distribution, and distributions are included on your tax return as taxable income in most cases. They’re treated as ordinary income, taxable at your marginal tax rate.

What does total distribution mean on 1099-R?

“Total Distribution” indicates all your contributions were disbursed. “Taxable Amount Not Determined” if you retired in 1986 or 1987, LASERS is unable to determine the taxable amount because IRS. allowed you multiple options (see IRS Publication 939)

How much tax do you pay on 1099-R?

Funds distributed directly to the taxpayer are generally subject to a 20% federal income tax withholding. This means that the taxpayer must contribute additional funds in order to make up for the 20% that was withheld so that the rollover amount is equal to the total distribution.

Why are distributions not taxed?

A non-taxable distribution is a payment to shareholders. … It’s just not taxed until the investor sells the stock of the company that issued the distribution. Non-taxable distributions reduce the basis of the stock. Stock received from a corporate spinoff may be transferred to stockholders as a non-taxable distribution.

How do you determine the taxable amount on a 1099-R?

To determine the amount to enter in Box 2a (Taxable amount), subtract the amount in Box 3 Capital gain, and Box 5 (Employee contributions) from the Gross distribution (Box 1) and enter that difference in the Form 1099R screen Box 2a.

Do I have to pay taxes on a 1099-R Code 7?

If Box 7 of your 1099-R shows a 7 in it, this distribution isn’t taxable if you met the plan requirements (the age and/or years of service required by the plan) for retirement, and you retired after meeting those requirements.

Is Box 9b on Form 1099-R taxable?

Box 9b on the 1099-R shows the amount of the employee “contribution” to the retirement plan. … If the taxpayer didn’t make any after-tax contributions to the retirement plan (as is often the case), then the “basis” is zero, and each distribution from the retirement plan is 100% taxable.

Does a 1099-R count as earned income?

Since income on Form 1099-R is unearned income, it does not count as earned income for the purposes of figuring the amount of the EIC. However, if the income on Form 1099-R is taxable, it may increase a taxpayer’s adjusted gross income, which could reduce the amount of EIC he is eligible to receive.

How much tax do you pay on a 1099-R?

Funds distributed directly to the taxpayer are generally subject to a 20% federal income tax withholding. This means that the taxpayer must contribute additional funds in order to make up for the 20% that was withheld so that the rollover amount is equal to the total distribution.

Is 1099-R Code J taxable?

16070: 1099-R – Box 7 Code J Code J indicates that there was an early distribution from a ROTH IRA. The amount may or may not be taxable depending on the amount distributed and the taxpayer’s basis in ROTH IRA Contributions. This information must be entered for the software to calculate the taxable amount.